delayed draw term loan vs term loan

Delayed draw term loans may come in. Draw term loans are.

Understanding The Construction Draw Schedule Propertymetrics

Term Loan C bears a current interest rate of LIBOR plus a spread.

. Go to the LendingTree Official Site Now. Ad Get Your Small Business Funded Fast. Apply Now Get Low Rates.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Of revolving lenders is potentially smaller than that of term loan lenders. Nerdwallet Reviewed Refinance Lenders To Help You Find The Right One For You.

Define Delayed Draw Tranche A Term Loans. Everything you need to know about Delayed Draw Term Loan. A delayed draw term loan is a provision in a term.

For a borrower a DDTL is a way to access acquisition financing relatively fast as little as three to five days. Compare up to 5 Loans Without a Hard Credit Pull. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan.

A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. Delayed Draw Loans and Term Loan. The withdrawal periods.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. Subject to the limitations set forth in this Section 205 a the Borrowers may upon notice from the Borrowers to the Administrative. Means the term loans made by the Delayed Draw Tranche A Lenders to the Borrower pursuant to Section 201bi.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. In its most basic form a term loan is a lump sum of cash paid back in fixed equal installments usually monthly typically at a fixed rate.

A delayed draw term loan is a negotiated element of a term loan where the borrower is given the right to request additional funds to be disbursed to it after the initial draw. The debt then becomes term loans with the same terms and pricing. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed.

A delayed draw term loan DDTL is a special feature in a term loanthat allows a borrower to withdraw predefined amounts of a total pre-endorsed loan amount. They are technically part of an underlying. Ad Compare Top 7 Working Capital Lenders of 2022.

The Delayed Draw Term Loan DDTL. A middle ground has become more popular in recent years. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives.

A DDTL is a type. For example they could range from 1 million to over 100 million. Delayed draw term loans are usually valued at very large amounts.

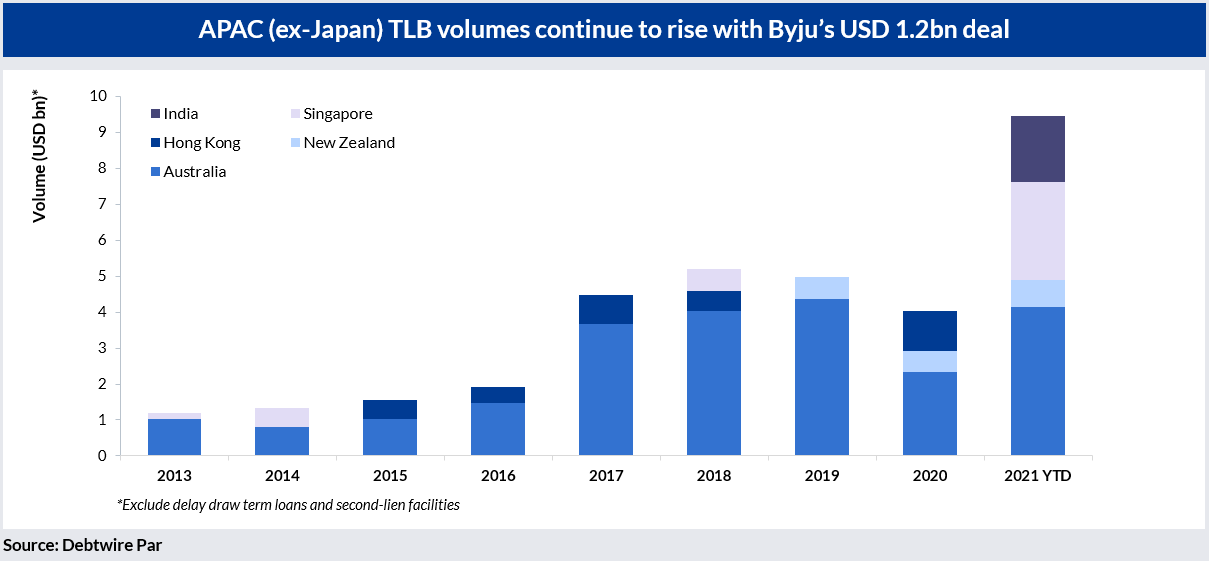

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Unlike a traditional term loan that is provided in a. DDTLs were used in bespoke arrangements by borrowers.

The lenders approve the term loans once with a. Nov 30 2020 A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved. Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics.

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Delayed Draw Term Loans Financial Edge

Advanced Lbo Modeling Private Equity Training Excel Template

Tree Line Capital Partners Linkedin

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Unitranche Debt Financial Edge

Stephen Merchant Director Of Finance Corelight Inc Linkedin

Unitranche Debt Financial Edge

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

Types Of Term Loan Payment Schedules Ag Decision Maker

Revolving Credit And Term Loans As Credit Alternatives To Firms In Mexico When And For What Purpose

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Tree Line Capital Partners Linkedin

Debt Schedule Video Tutorial And Excel Example

Types Of Term Loan Payment Schedules Ag Decision Maker

What Happens If I Miss A Payment Or Default On My Loan Forbes Advisor Uk